GST RETURN

GST Return

Experience a seamless and all-encompassing GST service with Team Start-up Sahay. From initial registration to hassle-free return filing, including GST reconciliation, we handle it all. Let us assist you in effortlessly submitting your monthly and annual GST returns. Timely and accurate filing is of utmost importance in the GST regime, as non-compliance and delays can lead to penalties, jeopardize your compliance rating, and impact your refund process. Trust us to ensure a smooth GST journey for your business.

Explore The Startup Ecosystem

Effortless, Transparent, and Seamlessly Smooth Process Unwavering Expertise and Personalized Support Complimentary Expert Consultation

Why Need GST Return?

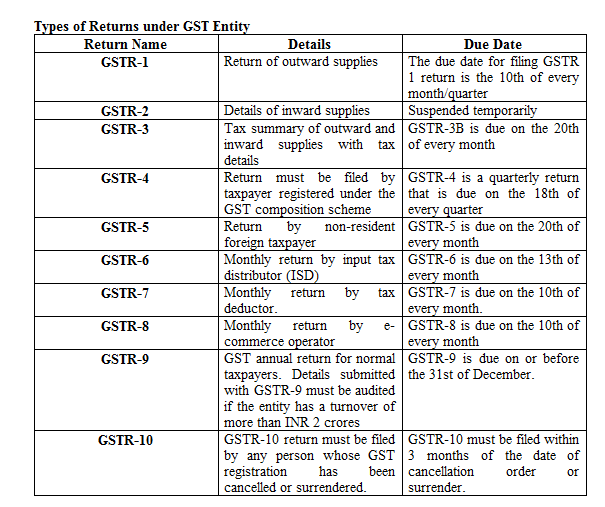

Under the GST system, it is mandatory for every registered individual to file their GSTR-1 (Return of outward supply) by the 10th day of the following month or at the end of the quarter. Additionally, GSTR-3B (monthly summary return) must be filed by the 20th of the subsequent month.

For traders and manufacturers registered under the GST composition scheme, it is necessary to file their GSTR-4 on a quarterly basis, with a deadline of the 18th of the month following the quarter. Furthermore, all GST-registered entities are obligated to submit their annual GST return before the 31st of December in the subsequent financial year.

Moreover, it is crucial to accurately file and reconcile various GST returns, such as GSTR-1, GSTR-2A, GSTR-3B, GSTR-4, GSTR-8, and the annual return, as they are internally interconnected. Ensuring precision in data filing and reconciliation is of utmost importance in order to maintain consistency and accuracy across all these interconnected GST returns.

Quick Service Request

Need Help?